Grocery Item Search Suggestions

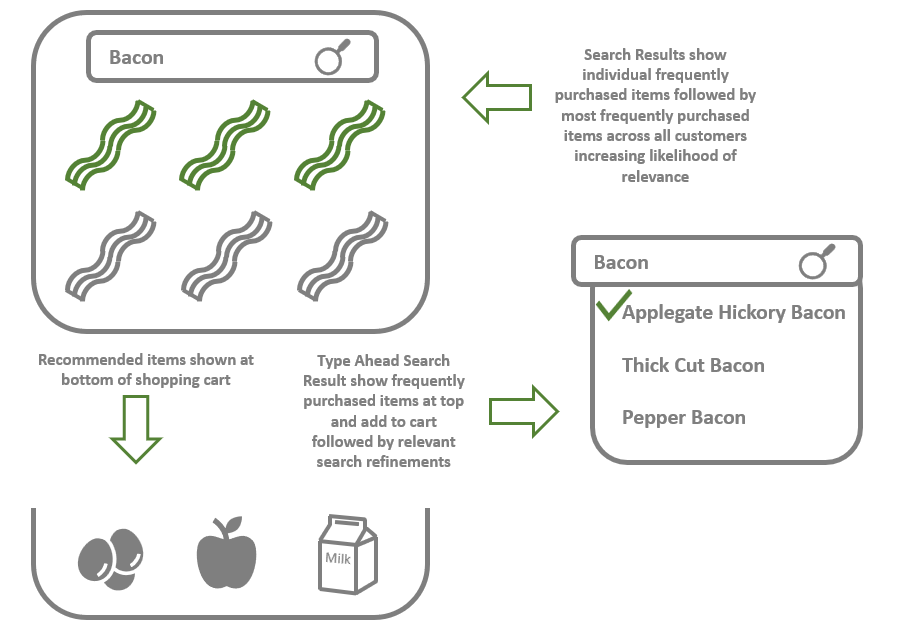

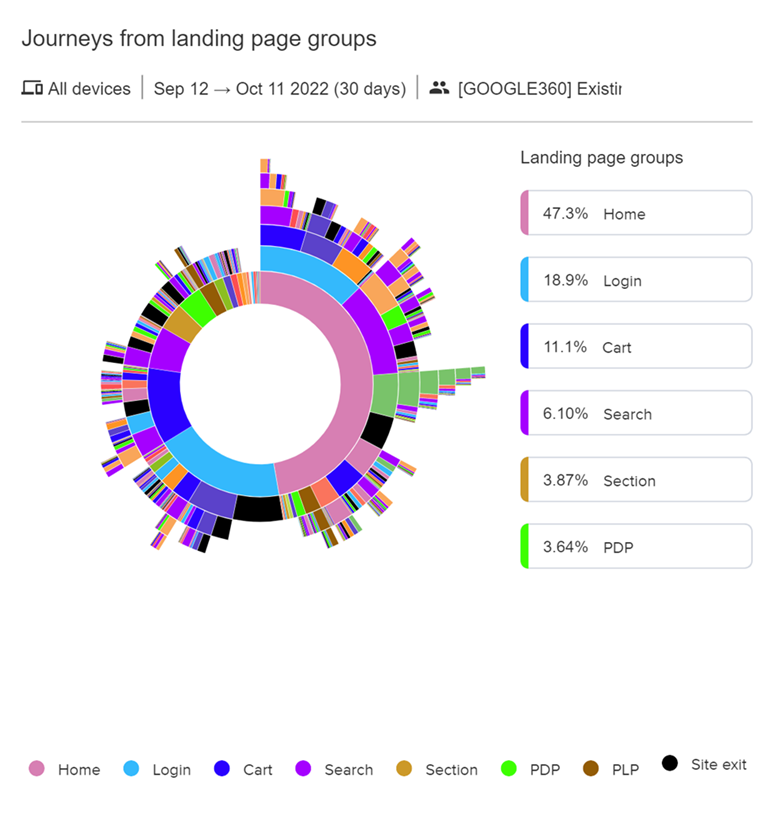

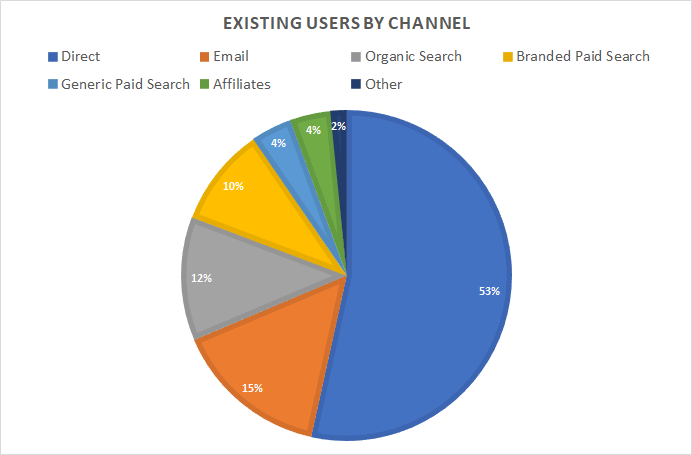

Existing customers frequently use the search bar to add items to the cart. Customers will typically search for items, add the item to the cart, then search again for the next item. Google Analytics doesn’t do a very good job of depicting this flow in analysis, so you have to dig deeper into the data to understand the flow.

Google has an analytics feature that allows you to see the “Search Refinement” within your site. Normally, this suggests that the customer uses a search term, doesn’t find what they want, and refines the search. But on grocery sites where customers are repeatedly searching and adding items to a cart, the next search is less of a refinement and more of a next item search. When the site employs various dynamic HTML features that allows the user to add an item to the cart without reposting the page, the analytics tracking doesn’t realize its a second item search.

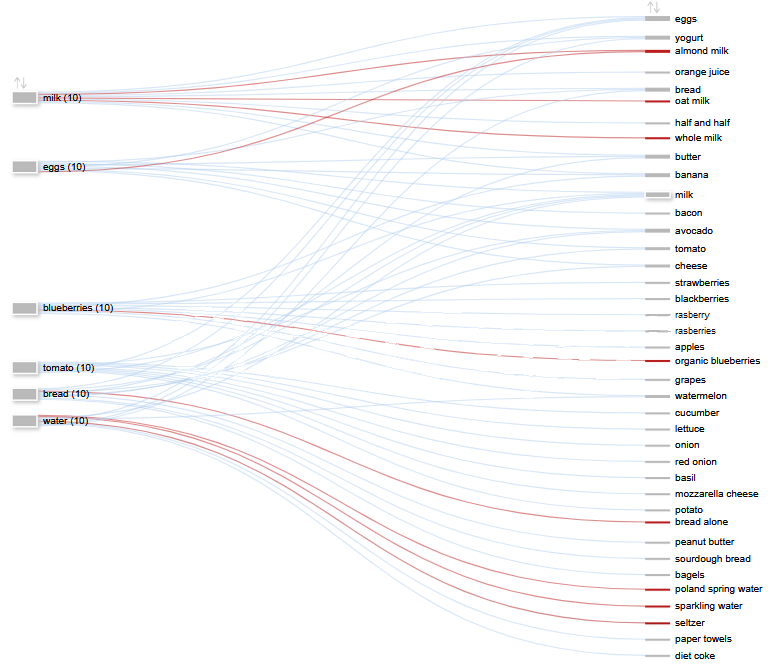

To analyze this behavior, we used Content Square and triggered an artificial page view to see when customers searched and then added an item to the cart. We saw that about 15% of the time, the user was refining the search and the other 85% the search was for the next item. See the chart below:

Here you can see a handful of searches in red are refinements and most are related searches in blue. For example the most popular searches after eggs are milk, bread, and bacon. The most popular searches after blueberries are other assorted fruits.

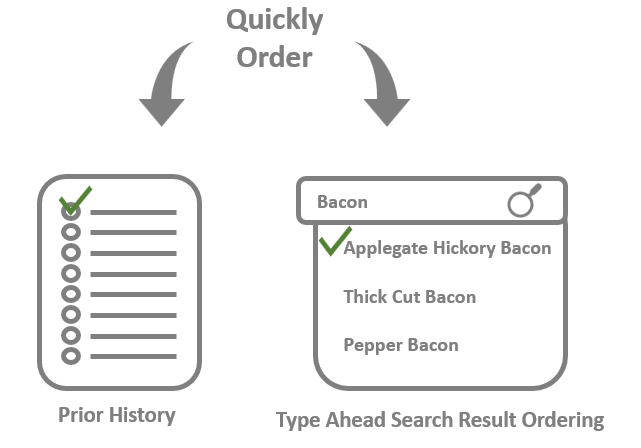

With this knowledge, a site can use algorithms to suggest the next item search. A good way of displaying that would be under the search bar with easy to click search terms for the next item. This would make the customer’s experience more efficient and would have the added benefit of suggesting additional items that the customer may have forgotten.

Now, why is the customer doing this flow? What are they trying to achieve? Typically, the customer will have a shopping list that they wrote down throughout the week and are then trying to add all those items to the cart. A more efficient way to do this might be to allow the customer to type all the items they are looking for at once and then cycle through each one.

K3Group can help you analyze your flow to make the customer’s shopping experience more efficient which leads to better customer satisfaction. Please see the other blog entries for more analysis of the online grocery shopping flow.

Explore More on Online Grocery Shopping Insights

- Grocery Item Search Suggestions – Learn how to enhance user experience with smart search suggestions in online grocery.

- Dynamic Assortments in Online Grocery Shopping – Discover the benefits of tailoring product assortments to meet shopper preferences.

- Building a Grocery Cart Faster – Explore strategies to streamline the cart-building process for faster, more convenient shopping.

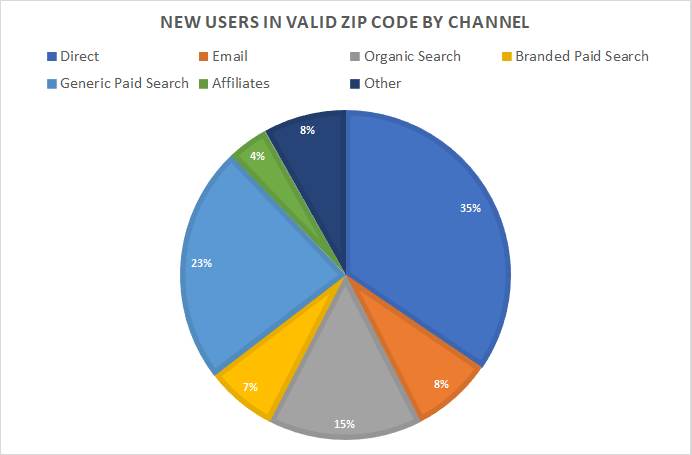

- Online Grocery Shopping Channel Analysis – Analyze key trends and performance across different online grocery channels.

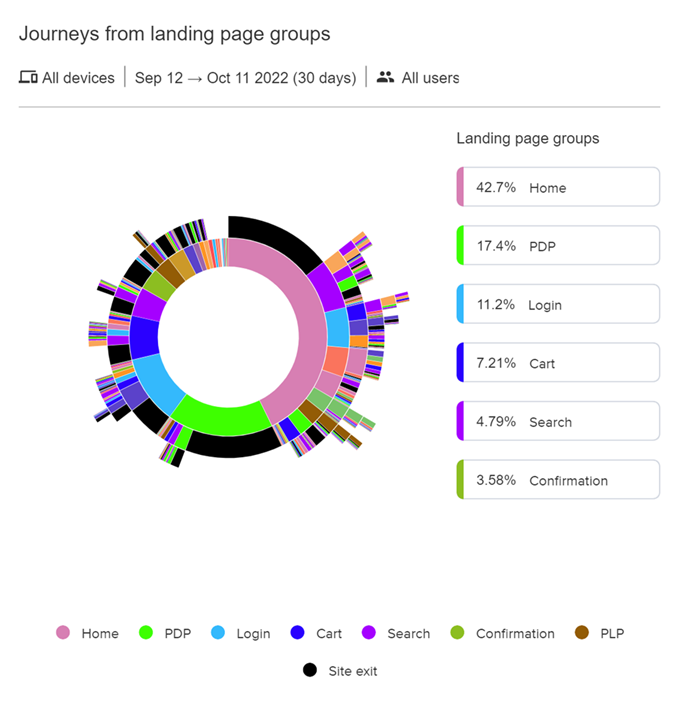

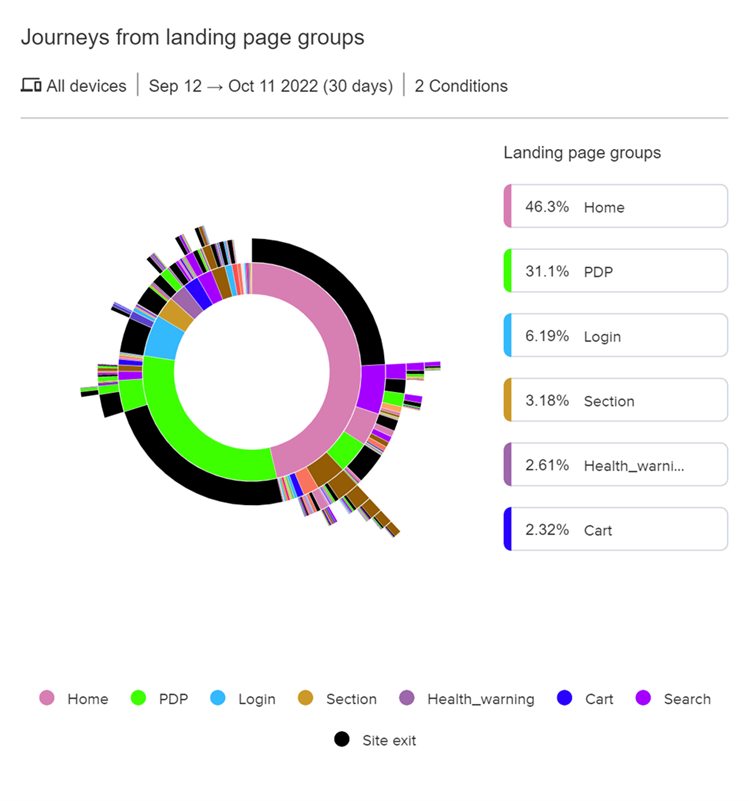

- Insights on Grocery Online Shopping Behavior – Gain insights into consumer behavior to inform your online grocery strategy.